By Tao Jiao

With the fast growth in computing power and the widespread use of new technologies, the accounting industry has been experiencing tremendous change. What entry-level accountants did ten or twenty years ago is very different from what they do right now. However, what we teach in college has not changed that much. This is especially true for fundamental accounting courses. As an accounting professor who teaches fundamental courses, I have been asking myself, “What is the value of my course for my students? Is it still useful?” I am afraid that my course is becoming outdated and will be replaced by other courses.

Of course, people could list multiple reasons why I should not be afraid. For example, accounting professionals agree that although computers can help people to do bookkeeping and generate statements, there are still a lot of tasks that computers cannot accomplish. For example, computers cannot replace human experts in analyzing financial statements as understanding the underlying principles and rationale of finance is key to its analysis. No matter how fast our business world changes, the rationale and principles are like a “constitution”: they always apply. As an accounting professor, I want to make sure my students have an excellent grasp on the principles.

However, besides the above reason, as an educator, I have been thinking what other value I can bring to my students. I always wonder if the framework or the methods taught in my classroom could help my students make better decisions in their life.

One of the objectives of financial accounting courses is learning how to use financial statements to help investors understand a company’s financial performance. I wonder if my students could also use the framework of financial statements to make their own “life statements”. By analyzing their life statements, they may have a better understanding of what they have achieved and what they may want to improve in the future.

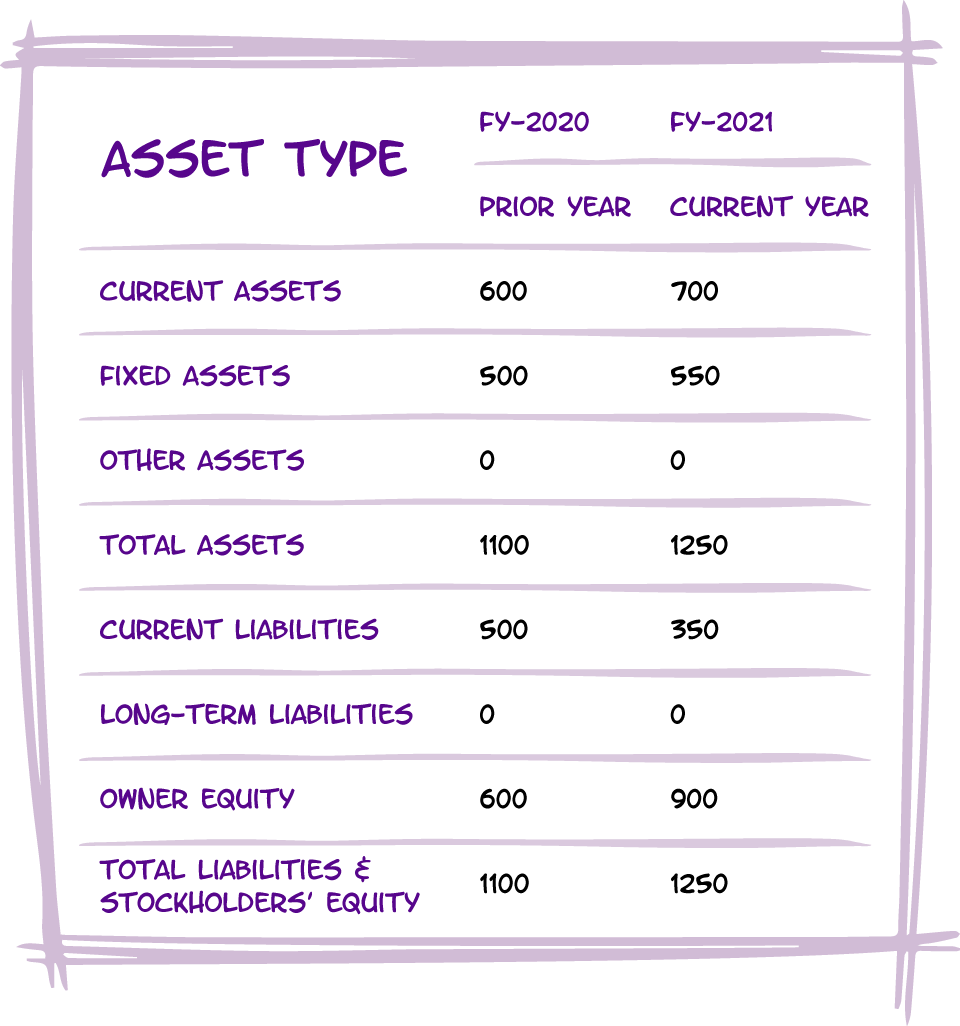

△ Balance Sheet

△ Life Balance Sheet

For example, let’s fill in a balance sheet with our personal assets. Our house, cars, savings, investments etc. are our tangible assets. Our experience, skills, knowledge, network etc. are our intangible assets. College students are comparable to start-ups, which are normally small in size and low in tangible assets. However, it’s not necessary for students to be anxious as they possess many intangible assets that older people do not have. Their energy, brain power and desire for success are at their peak in life. The key is whether they are aware of the existence of these intangible assets in their balance sheet and are able to use these assets to generate tangible assets and other intangible assets.

The other side of the life balance sheet tells us the sources of our assets. For college students, some of them may already have some liabilities, for example student loans. When these students make life decisions, they have to consider whether there is enough cash flow allocated to the debt repayment. However, even if some students are lucky enough to have no traditional debt sitting in their life balance sheet, they may still be some other types of obligations, like the obligation to pay back parents. We could argue that the contribution paid by parents can be recorded as stockholder’s equity, which is not obliged to be paid back. As a mother of two, this is how I see it. I don’t want to be an additional obligation for my kids. However, as I am middle-aged, on the one hand I have young kids to raise, and on the other hand I have old parents to take care of. I really wish people could plan some reserves to support these “stockholders”.

Is it possible to use what is taught in accounting or other business courses for life decisions? How do we use it? I don’t have a systematic and comprehensive answer. This is still open for discussion. As a professor who is teaching courses that seldom change in this fast-changing world, I do hope I don’t only teach business rules or principles, but that I also provide my students with long-lasting value.